In the event you Skyrocket Home loan?

Rocket Home loan was recommended for consumers who always create their residence financing on the internet if you can-anybody looking to buy a house out-of state, such as, may benefit from Rocket’s electronic-very first method and across the country impact. The financial institution also offers a smooth online application processes, in addition to capacity to create a home loan with the devoted cellular application. Consumers will need to talk to financing officials thru email address, but which might be far more convenient than simply conference actually otherwise speaking to the cellular phone. On top of that, home buyers who want way more direct recommendations can be most readily useful served using a loan provider having local department organizations.

Even after any limitations, Skyrocket Financial will bring a powerful avoid-to-prevent customer feel, and you will borrowers may feel comfy dealing with a lender one to centers exclusively towards lenders

Borrowers seeking the cashadvancecompass.com absolute lower rates may not discover them with Skyrocket Financial, but the lender’s cost is aggressive total and are entirely practical when you take into account wider mortgage speed style. Individuals may also be thinking about the goal of their house loan whenever consider the advantages and you may disadvantages away from Rocket Home loan financing. Skyrocket now offers an abundance of lenders to choose from, however, certain formal money options, for example USDA fund and you will HELOCs, are not available.

Once looking at the best mortgage lenders, of several possible homebuyers and you may residents looking for a beneficial re-finance will find one to Rocket Financial is the best option for them.

We separately reviewed this particular service by the weigh their says facing first-hand knowledge of their professionals. But not, because of affairs such as franchising, human mistake, and, take note see your face experiences with this particular business may differ.

Consumers having a cursory understanding of Rocket’s record can still inquire, what is Rocket Mortgage because it relates to Quicken Finance? Though it started out since a subsidiary off Quicken Money, Rocket Mortgage has had a meteoric popularity regarding the borrowed funds business since its first when you look at the 2015. Which have digital home loan techniques starting to be more stabilized along the community, organization features boomed into nascent providers, as well as brand has rapidly adult during the prominence and recognition. To such an extent, indeed, one to Quicken Money theoretically changed its identity in order to Rocket Financial within the 2021.

With respect to financial obligation, Skyrocket Financial suggests one prospective home buyers has a great DTI ratio away from no more than forty five percent. Simply put, borrowers ought not to save money than just forty five per cent of their month-to-month gross income into the recurring debt burden including book, car and truck loans, figuratively speaking, otherwise credit cards. Rocket’s underwriters might must be sure an applicant’s earnings, a career, and you may monetary property. Particularly, the lending company prefers borrowers that will reveal facts they have a steady performs reputation for two years or higher. Again, regardless of if, debtor criteria aren’t always set in brick, and you may programs conference which requirements tends to be accepted or denied from inside the response to other factors and you will factors.

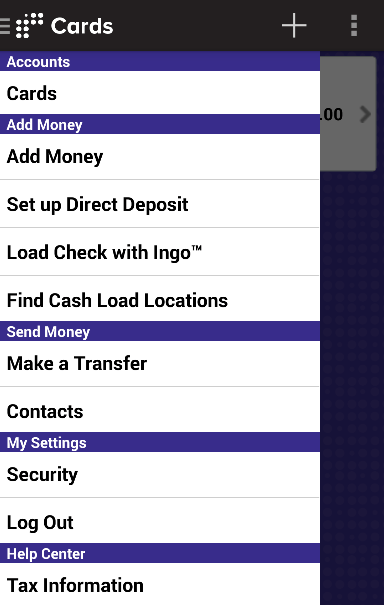

At any point during the techniques, borrowers have the choice to pause the on the web software and request one to financing administrator call them to walk through the kept steps over the phone. Individuals also can score help starting a unique app by the dialing brand new faithful Skyrocket Home loan contact number to possess financing recommendations and speaking so you can a mortgage Professional directly. While the Skyrocket Home loan customer support range is not discover 24/eight, its instances regarding process is actually pretty much time, which have agents position because of the late into the evening of many days.

Despite the general availability and you will variety away from customer care selection, it’s well worth listing one to Rocket Home loan does not have local department offices to possess consumers to meet up with that have mortgage officials actually. As home loans is processed electronically from start to finish, having less within the-people assistance may not be something for most homebuyers. Just in case you prefer head hands-to the help, however, this may be a critical downside to Rocket’s attributes.

Loan alternatives themselves are like that from a great many other lenders, but people may want to pay attention to certain limits showed from the Rocket words. In particular, Rocket Mortgage doesn’t already offer HELOCs otherwise USDA finance, while lenders for example PNC, Quality Home loans, and you can Protected Speed offer one or all of those individuals capital choices. Consumers in search of Sleeve investment will find Rocket’s conditions also limited, as the organization also provides merely seven- and you can ten-seasons Sleeve funds. Compared, Caliber Lenders will bring 3-, 5-, 7-, and you may 10-seasons Hands. Despite those potential concerns, Skyrocket Home loan stacks up really in other section which might be of significant benefits to home buyers or people seeking re-finance. Financial prices will stand close world averages, and lender’s qualifications requirements appear to be in range that have normal mortgage criteria.

Leave a Reply

Want to join the discussion?Feel free to contribute!