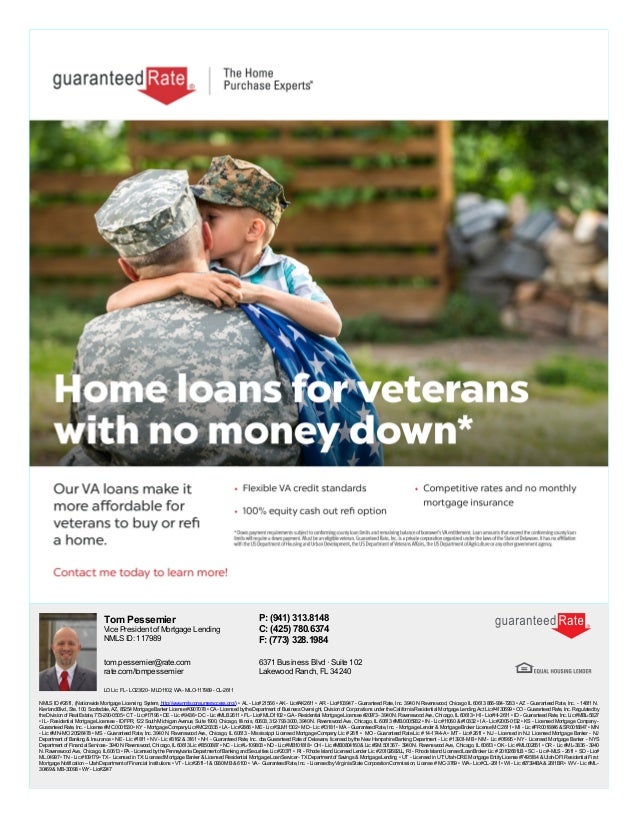

The us Institution regarding Experts Facts (VA) also offers experts, services members, in addition to their enduring spouses the chance to buy land without the need for a down payment or private financial insurance (PMI).

Va mortgages is actually secured because of the Federal government and gives the lending company with an increase of economic cover in case there are loan standard.

As the a dynamic provider associate or veteran of U. If you are intending when planning on taking advantage of Va loan experts, you ought to understand the latest qualifications criteria and you will entitlements. This article often speak about everything you need to know before you apply to acquire authorized by the lender and steer clear of troubles afterwards off the street. Keep reading to find out more.

Va Financing Qualification

Va finance are around for qualified experts, provider members, or surviving partners. However, their eligibility to own a beneficial Va financing is based on multiple things, together with your services dates, launch type, and you can whether you’re choosing Va handicap payment. Here’s what it will require to help you be eligible for a good Virtual assistant loan:

Typical Army Qualification

As qualified to receive Va lenders, services participants should have served about 180 times of continuous energetic obligations or perhaps 90 days out of persisted productive obligation whenever they was entitled so you can energetic obligation following the a nationwide emergency. The eligibility time starts towards go out your inserted your very first ages of energetic obligations. Simultaneously, the Virtual assistant possess distinctive line of conditions having service players exactly who supported throughout the wartime and peacetime. These two classes are recognized as employs:

Wartime

To be eligible for Va mortgage gurus, you’ll want supported at the very least 90 days out-of productive obligations throughout the wartime. New lower than battles/issues are certified:

- The second world war ( ranging from 9/ and eight/)

- Vietnam Point in time (anywhere between 8/5/1964 and eight/1975)

- Korean Argument (between 6/ and you can step one/)

- Persian Gulf Conflict (between 8/2/1990 and you can time to be given)

Peacetime

To-be eligible for Va financing positives, you must have offered on active obligations throughout peacetime. You may be believed an eligible peacetime experienced if you served during the:

- Post-The second world war (between 7/ and 6/)

- Post-Vietnam Battle (ranging from 5/8/1975 and you may 8/1/1990)

- Post-Korean Conflict (ranging from dos/1/1955 and you may 8/4/1964)

An experienced must fulfill specific lowest Va requirements to-be eligible having an effective Va financial. Basic, they should provides offered during the energetic military services during wartime for no less than 90 days, or at least 181 successive days throughout the peacetime. Its launch must also become below respectable requirements.

Reserves or Federal Shield Qualifications

Veterans and current Supplies and you may National Shield players meet the criteria for Virtual assistant lenders if the they’ve supported for 90 consecutive months. A book otherwise Guard veteran can get qualify for an excellent Virtual assistant loan in the event the they have half a dozen years of energetic services.

Reservists, Federal Shield people, and pros who supported on productive obligations on Gulf of mexico Conflict era are eligible for Virtual assistant loan gurus. So you can qualify, they have to was basically put-out of active obligation less than aside from dishonorable requirements at least ninety days before applying to own a beneficial Va financial. They must along with alive or operate in a county where Virtual assistant keeps an approved bank to make fund.

Thriving Partners Eligibility

Surviving spouses regarding forever and you may handicapped experts just who passed away from a great service-connected handicap can use the eligibility. It’s also possible to qualify for Va finance when your partner passed away into the energetic duty otherwise out of an assistance-brought about impairment, and you also did not remarry shortly after their partner’s death. Yet not, if you remarried upon turning 57 yrs . old immediately after your own wife or husband’s passing as well as on/once , you’re qualified.

The newest surviving partner regarding a service member having stated lost inside the action (MIA) otherwise kept because the a prisoner-of-war (POW) for around 90 days can also be eligible. In this instance, you’re simply right for a-one-day Va financing and you can excused of make payment on Virtual assistant Financial support Payment.

Other Eligibilities

- Societal Wellness Provider authorities

- Armed forces solution academy cadets

Exclusions

Some individuals qualify to have Va finance, good borrower’s eligibility is generally suspended or refuted in certain affairs. Luckily you to Virtual assistant also offers an array of conditions so you’re able to prospective candidates whose armed forces discharges were not as much as other criteria in place of honorable. Since there are an absolute level of Virtual assistant exceptions, it is in your best interest to talk an effective Virtual assistant mortgage specialist.

The newest Certification out of Eligibility (COE)

New COE is an important file given by the bank. It functions as evidence of entitlement to help you Va money. The latest COE isnt an alternative to a certification regarding Term or subscription, but instead an indication that Va has no objections with the getting their experts.

It certification are issued of the a great Va Regional Loan Center or important source a state’s Veteran’s Situations Department. They data that you served in several appointed kinds of services, including active responsibility, put aside otherwise shield, national guard, peacetime just, wartime simply. Brand new COE and listing their times of service and you can verifies your entitlement so you’re able to Va-guaranteed funds according to those people times.

Va Loan Entitlement

Va entitlement was a subject of numerous homebuyers find out about, but these are typically commonly not knowing of the way it works. The principles and you can laws close Va loan entitlement can appear complicated in order to veterans, particularly if they don’t comprehend the earliest particulars of taking a Virtual assistant mortgage to start with. Basically, entitlement is simply a means to display just how much you will be invited so you’re able to obtain from your own bank. Entitlement and additionally represent simply how much of one’s Va mortgage pros your are able to use to get a home.

The quantity you earn will be based upon affairs such as your impairment score, years of services, wartime otherwise peacetime solution, launch standards, one of almost every other qualification requirements. Additionally, your entitlement status means no matter if you be eligible for a beneficial full or limited no-deposit home loan.

Bottom line

A good Va loan would be a beneficial substitute for your home-to order means, particularly when you want to to acquire property you to will set you back far more compared to area’s median price. But qualifications and you will entitlement are two secret basics to store from inside the mind before applying to possess a beneficial Va loan since the they will certainly help you know what you are getting into the and make certain you happen to be by using the Virtual assistant loan from the most effective possible way.

Leave a Reply

Want to join the discussion?Feel free to contribute!