If another residence is in your wish number, you may talk about the options.

You can find potential benefits to buying an additional house, claims Kelli Slope, elder director regarding suggestions on Wells Fargo Wide range & Financing Government. Right here, Hill shares one or two very important considerations and you may three trick inquiries to ask yourself before you make the decision to put money into another household inside advancing years if not eventually.

Think leasing money – and just what renters wanted

Committing to the next domestic now to utilize as a vacation household now can help you create collateral over time. It due to full- otherwise part-big date rental income. You could potentially even use one to rental income to simply help defense the costs associated with the house or property, whether or not which is restoration and you will upgrades or constant mortgage repayments. And additionally, it can be simpler to be eligible for a moment mortgage when you find yourself you might be nonetheless totally working because your financial obligation-to-money ratio could be straight down.

The possibility to be effective remotely gets some body alot more freedom getting away from the chief domestic for longer extends of your time. That being said, high-top quality Wi-Fi and you can home business office space on the 2nd family could help attract such long-identity clients even after the newest pandemic subsides.

Enjoys a plan for additional expenses

Purchasing an extra house prior to when later years might have their advantages, like having the ability to bequeath the purchase price more a longer period of time during your getting ages and being capable enjoy the second house before you could retire.

But Hill cautions there will likely be a disadvantage to to order property now that you intend to have fun with actually just later. The fresh prolonged you own property, the greater number of the new associated expenses could be, she states. It is simply browsing cost more getting the house or property, so even though you order it prior to so you’re able to give the price out over recent years, the entire pricing itself will add up-over go out. People will set you back typically is expenditures about repair and you can fix, taxation, insurance policies, and you may, in some instances, homeowners’ association dues. And you will, during the times of rising interest rates and better rising prices, these types of costs are gonna boost.

Leasing property to help you anyone else also means you may be accountable for more will payday loan Glen Allen set you back, particularly paying for disaster repairs, such as a reduced hot-water heater otherwise plumbing issues that renters encounter. It is possible to desire get accommodations administration team to deal with reservations and you can fixes as you don’t have the time for you to usually the individuals matters yourself.

Secret issues to inquire about before you buy

Slope says that the answers to this type of about three crucial issues can be help you decide if this is the time for you to thought to invest in an extra family.

- Do you want another family now, or would you like it later on? Which concern makes reference to their prepared explore. In many cases, you may be happy which have the second family get whenever you are able to make usage of they each day in the recent years one which just retire.

- Would you defense most expenses if you are controlling most other financial concerns? A second family will be a costly asset to invest in, Slope claims. Thus you need to balance your capability to finance they and you can pay for it which have hardly any money disperse need you may have. It’s important to just remember that , the second residence is maybe not a good liquids resource. Which means you should envision access investments you to definitely can easily be converted to profit circumstances you would like ready access to funds.

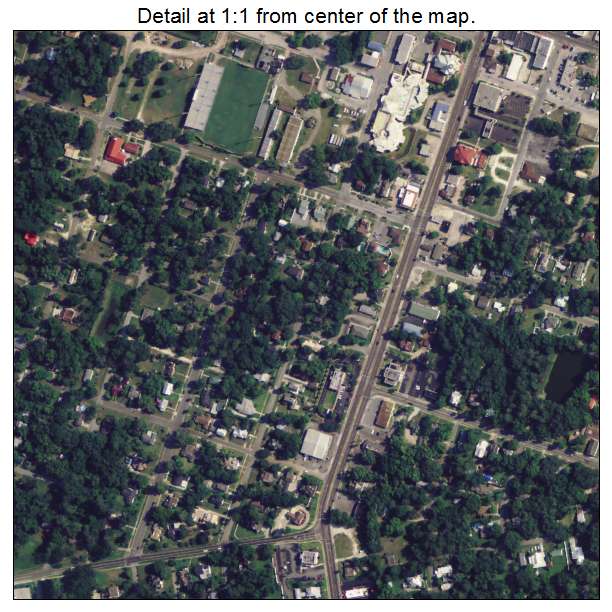

- Precisely what does the housing marketplace feel like today? Enough factors enjoy toward so it assessment, in addition to housing industry costs, rates of interest, and you can property collection. While aspiring to lease your second household as the a vacation property, whether or not it would appeal clients in the long term should be thought. What is the travel local rental markets in your neighborhood? Hill asks. Could there be an urban area otherwise a region nearby that gives shopping, dining, otherwise activities? Which are the features in the home? Simply how much of the home do you wish to funds?

Envision revealing then having judge and you can financial advisers

Due to the fact acquisition of an additional household have implications into the your money, home agreements, and you will old age goals, Slope implies your speak with a legal professional and you can an economic mentor. They might help you determine how to purchase another household and any related costs you are going to match your investment specifications and you may agreements.

Wells Fargo Wide range & Capital Administration (WIM) is actually a division inside Wells Fargo & Organization. WIM will bring financial products and functions by way of some lender and you can broker associates out-of Wells Fargo & Team.

Wells Fargo Advisors and its associates do not render judge otherwise taxation advice. People property bundle are assessed of the an attorney who specializes inside the house considered which can be signed up to rehearse law on the county.

Leave a Reply

Want to join the discussion?Feel free to contribute!