Regarding the PennyMac

So it character wasn’t said because of the providers. Pick critiques lower than to find out more or fill in their review.

S. It originates funds in most fifty claims and provides 100 % free customized speed quotes in place of delivering your own personal pointers. PennyMac try dependent inside the 2008 and is situated in Westlake Community, Ca.

- No from inside the-person branches

- No domestic security finance otherwise HELOCs

Prices

PennyMac posts pick and you may refinance mortgage pricing on the the webpages. These rates imagine individuals loan conditions, very they are simply suggested for-instance offering. You can purchase a custom offer, which takes lower than a moment and needs zero individual identifying suggestions. PennyMac demonstrates to you rates, yearly percentage cost (ounts a variety of financing.

PennyMac’s financing selection were one another repaired-rate and variable-price mortgages (ARMs). Fixed-rate finance features an increase and you can payment that remains a similar in the loan title. Hands from PennyMac features an initial repaired-rates months which have a low rate to have either four, eight otherwise a decade; the interest rate up coming adjusts twice a year according to an index and you may a margin set from the lender.

From inside the three-seasons months off 2019 so you can 2021, predicated on Home mortgage Revelation Act data, PennyMac’s average house buy rates is lower than brand new federal mediocre.

App procedure

To get home financing off PennyMac, you could begin the process by requesting a free of charge, no-obligations designed price price – or you can diving inside the and commence the fresh new preapproval processes.

Brand new personalized rates unit requires a number of effortless questions about brand new style of mortgage you are interested in, the house along with your credit history. It will upcoming render ideal-complement financing possibilities and you will estimated costs and you will money.

Observe genuine speed has the benefit of, start the fresh new preapproval procedure by the responding a series of concerns and bringing your own and contact information. A beneficial PennyMac associate following is at out to your. As an alternative, you could potentially skip the online survey and label the lending company really.

While you are preapproved, PennyMac have a tendency to protected your rates for up to two months. You could lock prior to you might be even yet in bargain to your a house.

Regarding software processes, it’s possible to help you upload, indication and you will make sure records within mortgage supply heart (yards.a.c.) and you may tune the latest advances of your software.

Loan sizes

PennyMac now offers antique mortgages (fixed- and you will adjustable-rate), jumbo funds (getting large-value attributes) and you may FHA, Va and USDA loans. There is also a specialty system to possess money spent finance.

Of 2019 so you’re able to 2021, just how many domestic buy money finalized because of the PennyMac almost twofold, based on studies on Mortgage loan Revelation Act. Within the 2021, PennyMac acquired over 25,100000 household pick loan applications; it finalized towards 18,531 money and you will rejected step one,864 (eight.5%) programs.

Refinancing

You might refinance with PennyMac getting a lesser rate, decrease your payment, repay your loan shorter otherwise get cash out of established domestic collateral. Their refinancing calculator helps you recognize how far you would help save monthly and over the entire mortgage title.

Inside the 2020 and you may 2021, since the prices was basically striking historical downs and consumers tried to pay smaller interest, PennyMac generated a top part of re-finance money. Into the 2020, more than 88% of its funds was in fact re-finance funds; when you look at the 2021, the fee popped to around 90%. Since rates jump right back, family loan providers are required to close into the less refinance fund.

Criteria

PennyMac fundamentally need a credit score with a minimum of 620 having a normal financing, together with a downpayment of at least step 3%. Additionally, it suggests that have an obligations-to-money (DTI) proportion out of just about 45%. If you’re looking getting good jumbo loan, you need a credit rating of at loan for wedding free least 700, a beneficial % advance payment and you will a beneficial DTI proportion of 43% otherwise straight down.

PennyMac will not publish lowest credit ratings for its bodies-paid loans, such FHA, Va and you may USDA. Normally these have straight down minimum credit score requirements than simply a conventional mortgage. You could qualify for an FHA mortgage which have the absolute minimum borrowing from the bank get away from 500 – however, observe that in the event the credit rating is actually lower than 580, you desire a downpayment with a minimum of 10% (people who have a score a lot more than 580 can be set step three.5% down). Va and you will USDA financing don’t require down money.

For money spent fund, PennyMac needs a downpayment away from 15% in order to twenty five%, according to types of property. In addition says you will have an excellent or advanced borrowing and a beneficial DTI ratio of only about 50%.

Cost and charge

Locate an estimate of will set you back and you can charges to the a great PennyMac loan, you really need to pertain. Just after acquiring the job, PennyMac will be sending your financing Imagine means which have rates from financing costs, as well as settlement costs. Afterwards in the act – about about three business days before closing – you’ll get an ending Disclosure setting with an increase of particular number, such as the right count you will want to provide closing.

PennyMac offers a way to save money at closing on the specific fund. Consumers just who rating preapproved for a purchase loan are eligible for an excellent 0.5% dismiss from the dominating amount borrowed, applied just like the a benefit towards settlement costs or principal. PennyMac along with waives this new $step 1,two hundred origination payment for the traditional and you will FHA finance.

PennyMac is actually a financial functions team you to definitely focuses on originating and you may maintenance mortgages. It absolutely was centered when you look at the 2008 that will be located in Westlake Community, California, inside the west Los angeles State.

PennyMac is just one of the largest lenders and you can servicers into the the new You.S. From the 1 year ending toward , they produced $166 million in the financing originations, with respect to the team.

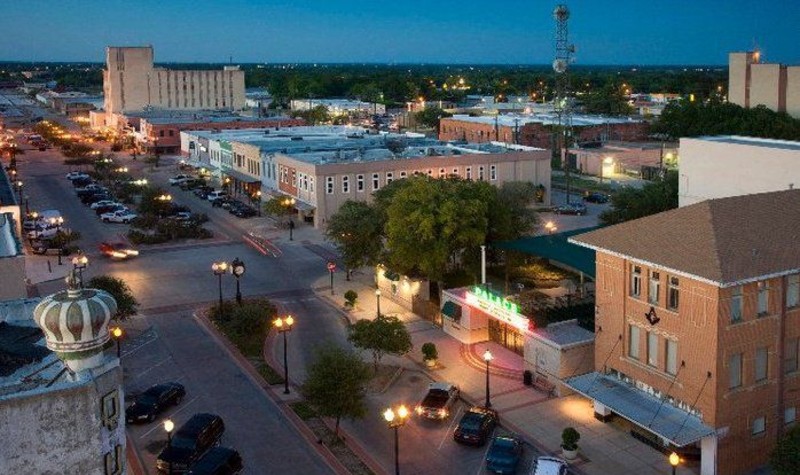

PennyMac are signed up in most 50 says. It’s got sales organizations inside Washington, California, Florida, Their state, Las vegas, nevada, Tennessee and you may Texas.

Leave a Reply

Want to join the discussion?Feel free to contribute!